Scenario Space

Matthew Wagstaffe / 2018

Yale School of Architecture

Yale School of Architecture

Towards the end of James M. Cain’s Double Indemnity—a 1943 noir mystery with

an insurance claims manager in the role of detective—Barton Keyes, our insurance

agent hero, seeks to prove the fraudulence of a supposed suicide. Lacking any

substantive evidence, Keyes instead turns to the actuarial tables for proof:

I was studying these tables. Take a look at them. Here’s suicide by race, by color, by occupation, by sex, by locality, be seasons of the year, by time of day when committed. Here’s suicide by method of accomplishment. Here’s method of accomplishment subdivided by poisons, by firearms, by drowning, by leaps … [Here] are leaps subdivided by leaps from high places, under wheels of moving trains, under wheels of trucks, under the feet of horses, from steamboats. But there’s not one case here out of all these millions of cases of a leap from the rear of a moving train. That’s just one way they don’t do it.[1]

His speech, breathless and list-like, rhetorically performs a comprehensibility. One is given the sense that his actuarial tables are potentially all-encompassing—with more and more “here’s’ ” Keyes could effectively elaborate the sum total of suicide possibilities. Significantly, this list of statistically allowable categories is granted enormous predictive powers: that which is “not classifiable” according to the probabilistic logics of actuarial science, Keyes implies, is effectively “an ontological impossibility.” If some future circumstance cannot be inferred from the probabilities [2] suggested by the data available in the present, it may as well not exist.

Years later, at the height of Cold War hysteria, Herman Kahn of the RAND Corporation was putting forward the opposite worldview: that which is statistically unfathomable (in this historical circumstance, Nuclear War or another atomic disaster), he argued, is precisely what one cannot disregard. The probabilistic logics that dominated future-forecasting in days past, Kahn contended, were unsuitable for dealing with unprecedented events about which there is a “paucity of actual examples.” In this situation of uncertainty, Kahn proposed a new method of [3] speculation which he called “scenario planning.” Defined as an “attempt to describe in more or less detail some hypothetical sequence of events” scenarios take the form of [4] imagined narratives that “dramatize and illustrate” the “larger range of possibilities that must be considered in the analysis of the future,” thereby ensuring that the futurist “deal[s] with details and dynamics that he might easily avoid treating if he restricted himself to abstract considerations.” Thus, here the abstractions of statistics [5] are viewed with suspicion and the unpredictable is not written off as an “ontological impossibility,” but is instead granted an ontological reality; that is, through a speculative narrative the unknowable is made to seem real.

This method of giving narrative life to alternative futures far outlived its Cold War origins. In 1961 Kahn left RAND to form the Hudson Institute, his own think tank/consultancy where, amongst other futurological activities, he created the “Corporate Environment Study,” a seminar designed to teach “the secrets of scenario” planning to corporate planners across the globe. His most notable pupil was Pierre [6] Wack, a planner at Shell Oil who would go on to use and adapt Kahn’s scenario methods to analyze the possible changes in the supply and demand of oil. Wack outlined a number of potential scenarios including a “crisis scenario,” in which he imagined Middle Eastern countries limiting oil production for political reasons. This scenario, which bore great resemblance to the OPEC crisis of 1973, helped Shell Oil to weather that embargo with comparatively little losses, a success story that served as an advertisement for the values of the scenario planing to corporations everywhere.[7] Scenario planning, along with business continuity planning and other practices oriented towards managing more micro-level uncertainties, are now mainstays of management culture.

I am curious about the rise of this second form of future management and what it might say about the contemporary logistics-oriented business world that now employs it. Might the turn to a future-strategy as speculative and pluralizing as [8] scenario planning reveal something about the logistical mindset? I hope to show that some of the conceptual ideas underlying Kahn’s embrace of scenario planning— specifically, a chaos-theory inflected view (which I will explain explain below) that sees the components of the physical world as so interrelated that even minor actions produce major effects—have an elective affinity with some of the realities of the contemporary supply chain, that is, a system in which each part is intricately dependent upon the other. Additionally, I will argue that scenario planning’s strategy for dealing with the uncertainties that result from an overly complex world—the creation of multiple possible futures—bears great similarity to the endless disaster recovery and business continuity plans that are required for the functioning of the logistical operation. Finally, through an analysis of some actors in the Business Continuity Industry I will attempt to show that the spatial logics of accounting for a variety of potential disasters are very different from the spatial logics of an insurantial system, which deals less with risk-mitigation and more with the financial spreading of risks whose likelihoods it knows well in advance. Risk mitigation produces distributed sites with no center, or, at the very least, auxiliary sites for each major operation. But, before undertaking an analysis of Scenario Planning and its relationship to logistics, it will be necessary to examine in greater detail the insurantial and probabilistic logics against which Scenario Planning defines itself.

The philosopher of science Ian Hacking dates the rise of probability to the midnineteenth century, a time that produced an “avalanche of printed numbers.” Hacking [9] attributes this increase in numerical data principally to the new Industrial era. The rise of numerical records, he writes, is “embedded in the grander topics of the Industrial Revolution. The acquisition of numbers by the populace, and the professional lust for precision in measurement, were driven by familiar themes of manufacture, mining, trade, … railways.” From this industrial data emerged a new worldview: in contrast to [10] notions of causality and inexorable human natures, mathematicians discovered, in the 19th century’s vast numbers, the laws of probability and statistics. In so doing, the “idea of human nature was displaced by a model of normal people with laws of dispersion.” [11]

Through these new sciences emerged the enterprise of insurance, and with it, the notion of risk, which Francois Ewald argues “has no precise meaning other than as a category of [insurance] technology.” Ewald describes risk as the statistical likelihood of an event occurring that will have a negative effect on “values or capitals possessed or represented by a collectivity of individuals.” The notion of collectivity here is key: the [12] science of probability only works when one has large enough numbers of people engaged in the same behavior over a long enough period of time—this way, one has enough data from which to draw statistical inferences. Risk, in fact, only becomes calculable “when it is spread over a population. The work of the insurer is, precisely to constitute that population by selecting and dividing risks. Insurance can only cover groups; it works by socializing risks. It makes each person a part of the whole.” There [13] is no possible way to determine the likelihood of a specific individual enduring an accident. But if that person is considered as part of a community of, say, miners, there are enough statistics on mining accidents over the years to precisely calculate his risk of injury.

Ewald himself points to mining (and industrial workplace accident insurance in mid-nineteenth century in general) as being a prototypical example of a wellfunctioning insurance market. Years upon years of repeating the same activity in countless similar mine sites produces a highly robust set of statistics from which can be extracted accurate probabilities of an accident occurring. Moreover, any disasters that occurred at a mine would be limited to that site—only the miners would be affected by a cave-in—so it is very easy to to determine who is bearing the risk. Indeed, Ewald sees this industrial-era insurance as so well-functioning that he posits it as central to the world order of the time:

The technology of risk, in its different epistemological, economic, moral, juridical and political dimensions becomes the principle of a new political and social economy … Insurance at the end of the nineteenth century signifies at once an ensemble of institutions and the diagram which which industrial societies conceive their principle of organization, functioning and regulation. Societies envisage themselves as a vast system of insurance.[14]

How then did we pass from such a situation—in which probabilistic thought was arguably a central pillar of social cohesion—to a world highly influenced by scenario planning, a field that “reject[s] claims about a turbulent future in probability terms” as “irrelevant” and “meaningless”? One hypothesis for our shift into [15] alternative means of monitoring the future is offered by Ulrich Beck and his theory of the “risk society.” In our era of advanced, techno-scientific industry (Beck’s Risk Society was released in 1986, coincident with the Chernobyl disaster, the exact kind of situation that one of Kahn’s apocalyptic scenario-planning mind would have salivated over), Beck argues, we face potential catastrophes of a “different quality” than the previous industrial era. Beck has in mind here vast environmental degradation, radioactive decay, nuclear disasters, and the presence of toil chemicals in our air and foodstuffs. These potential disasters are of a size, timeframe and irregularity that is unprecedented. Whereas the effects of previous accidents rarely extended beyond their immediate site—say, the industrial mine—chemical or nuclear accidents potentially affect the entire globe. These effects are likewise extended in time, oftentimes “outlast[ing] generations.” These factors, Beck argues, have resulted in a world [16] system that is “beyond the insurance limit.” That is, because these disasters are [17] exceptional, there is not enough data to determine their probability, and because these potential catastrophes are so extensive, we are no longer able to effectively separate people into the populations that allow us to determine risk. Statistics and probability no longer hold.

When a potential event passes beyond the threshold of these calculative logics, it ceases, definitionally, to be a risk. Instead, Ewald argues, it becomes an “uncertainty,” which he defines as something that one can “apprehend” (one knows, for example, that a nuclear disaster is possible) “without being able to assess” (there is no way to calculate the statistical likelihood of nuclear attack occurring). This eclipse [18] of insurantial reason via the dangers of advanced industry sets the stage for Kahn’s scenario planning methods. Without statistics, there is “a sort of hiatus and time-shift between the requirements of action and the certainty of knowledge.” In such a situation, Ewald argues, it “will be necessary to take into account what one can only imagine, suspect, presume, or fear.” Hence Kahn’s narrative speculations.

This awareness of the geographically extensive and unknowable dangers posed by technoscientifically advanced industries—of which nuclear war is the ultimate representation—however, was not the only force contributing to the rise of scenario planning. There were, in the 1960s, developments in mathematics that called into [20] question the notion that calculative logics are able to predict the future with any certainty at all. In 1961, MIT meteorology professor Edward Lorenz was running highly advanced (for the time) weather simulations, when he left his office to get a cup of coffee. Prior to running his simulations he’d rounded down a data entry three decimal points (from .506127 to .506). Lorenz returned from his break to find that the minor alteration had “drastically transformed” the entire pattern of the results of his weather model, showing that “small changes can have large consequence” and that, therefore, “forecasting the future can be nearly impossible.” R. John Williams, in his account of [21] these events, argues that this discovery (which formed the backbone of chaos theory and has since become know colloquially as the “butterfly effect”) showed that “the increasingly dazzling powers of mechanized computation, rather than fulfilling the Laplacian promise of total prediction and futurological singularity, led instead to a radically proliferating system of bifurcations and chaotic plurality.” It is with this [22] radical discovery as a backdrop, Williams argues, that we can make sense of Herman Kahn’s embrace of scenario planning over more statistically-inclined studies that use “high-speed computer[s]” in an “attempt to “find the ‘optimum’ system, given some reasonably definite set of circumstances, objectives, and criteria.”[23]

Thus we see that scenario planning represents a massive shift in terms of how knowledge about the future and potential threats is conceived—and really, it constitutes a major shift in the conceptualization of the interrelation of society’s members. If insurantial logic is predicated upon the carving up of the social body into clearly demarcated groups of populations, each with its own independent risk profile that is not affected by the risks of other segments of the population, the logics undergirding scenario planning could not be more different: here potential negative effects are completely extensive; through the influence of chaos theory, all parts of the social whole are seen to be intricately related, such that a small change in one area can have affects throughout the entire system. It is here, in its conception of the complete inter-connectivity of all parts of the social world, that I believe scenario planning most dovetails with the logics of logistics.

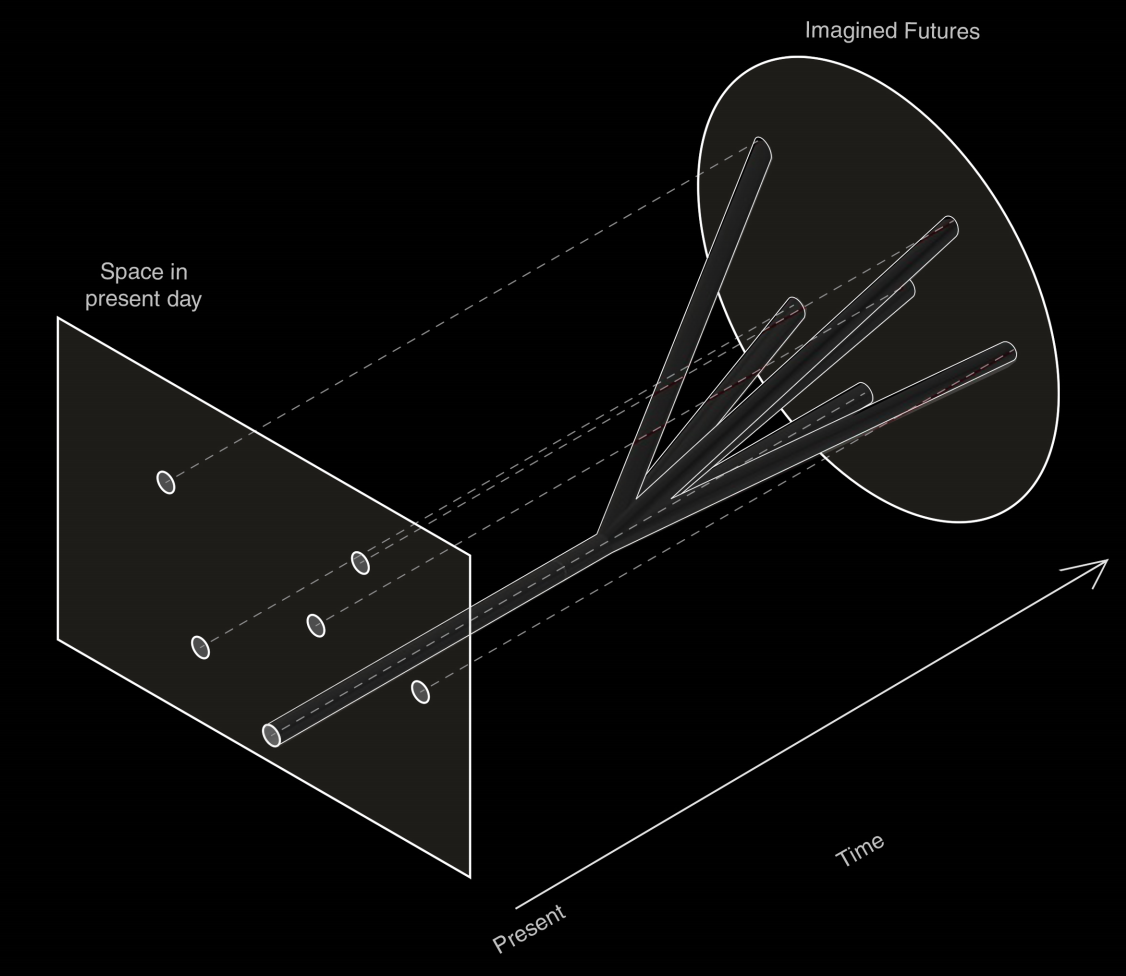

![]() Fig. 1

Fig. 1

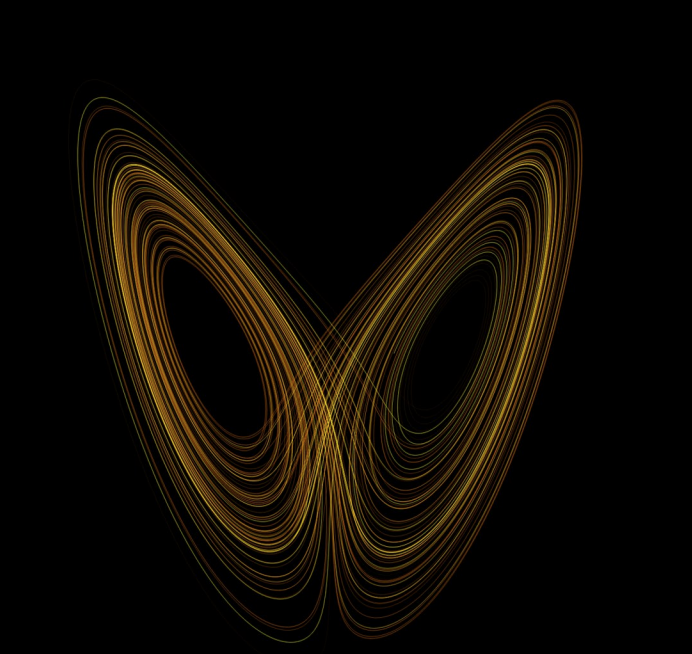

![]() Fig. 2

Fig. 2

For the science of logistics is likewise predicated upon the notion that all parts of an operation must be seen in relation to one another. In his essay “The Logistics Revolution and Transportation” W. Bruce Allen describes logistics as exactly such an inter-connected system. Allen contrasts the frame of mind of a “typical” corporate actor with that of a logistician. The traditionalist, he writes, takes as a given that “x tons of widgets must be shipped from A to B” and then asks herself “what is the cheapest fulldistribution cost mode to ship by?” The logistically-oriented, in contrast, “ask[s] questions of whether x was the best amount to ship and whether to ship from point A to point B was the proper origin-destination pair.” In logistics, then, no variables are pre-determined, and, in a true Lorenzian manner, no variable can be written off as insignificant; any alteration could affect the functioning of the logistical operation and so should be considered in the final layout of affairs. Furthermore, just as the highcomputational powers of Lorenz’s modeling system revealed greater chaos and plurality, so too does the logistical operation begin to look more and more everchanging and unpredictable as it expands its processing power. And so we see, in Peter Klaus and Stefanie Müller’s survey of logistical thought, that as logistics adds to its equation not just “traditional intra-organizational and cross-organizational supply chain” issues but also factors at the scale of “national and international cooperation” the result is not a increasingly optimal and precise operation. Instead, as logistics is able to cogitate more and more variables—from “macro-flows of goods, money, and people” to soon-to-be-scare resources such as “crude oil and water” to the shifting “comparative advantages between nations”—it has to imagine a new “type of network structure” that is able to take into account “conditions of ever more turbulent, volatile natural, economic, and political environments.” The future looks more uncertain, and [25] logistics must become, by consequence, preemptive and reactive.

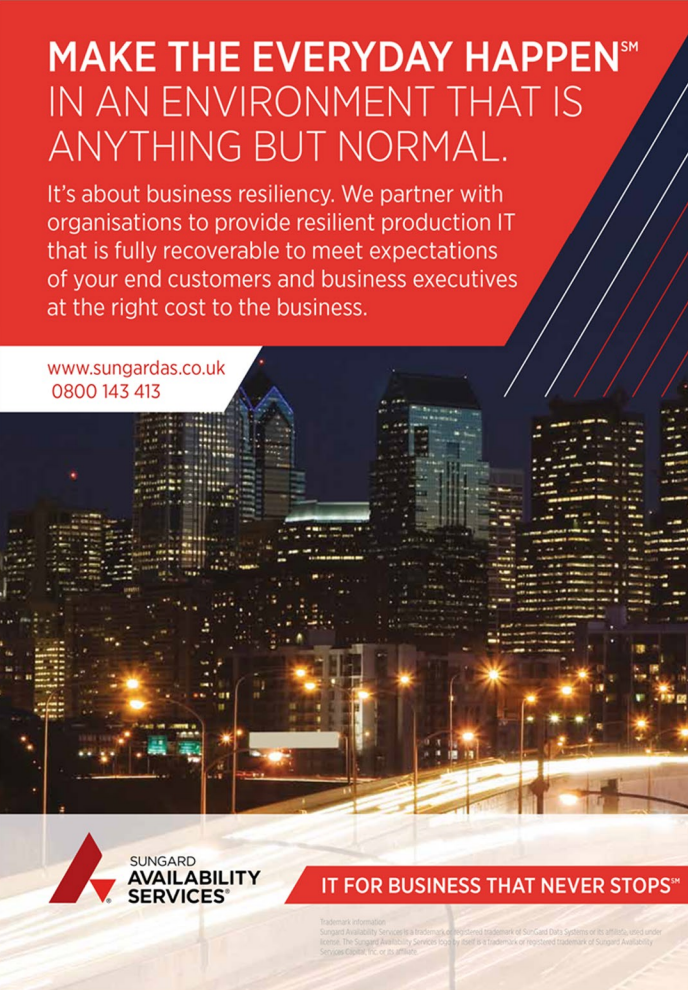

![]() Fig. 3

Fig. 3

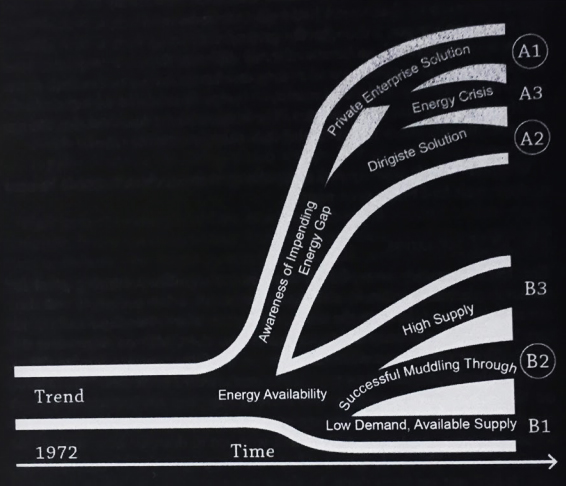

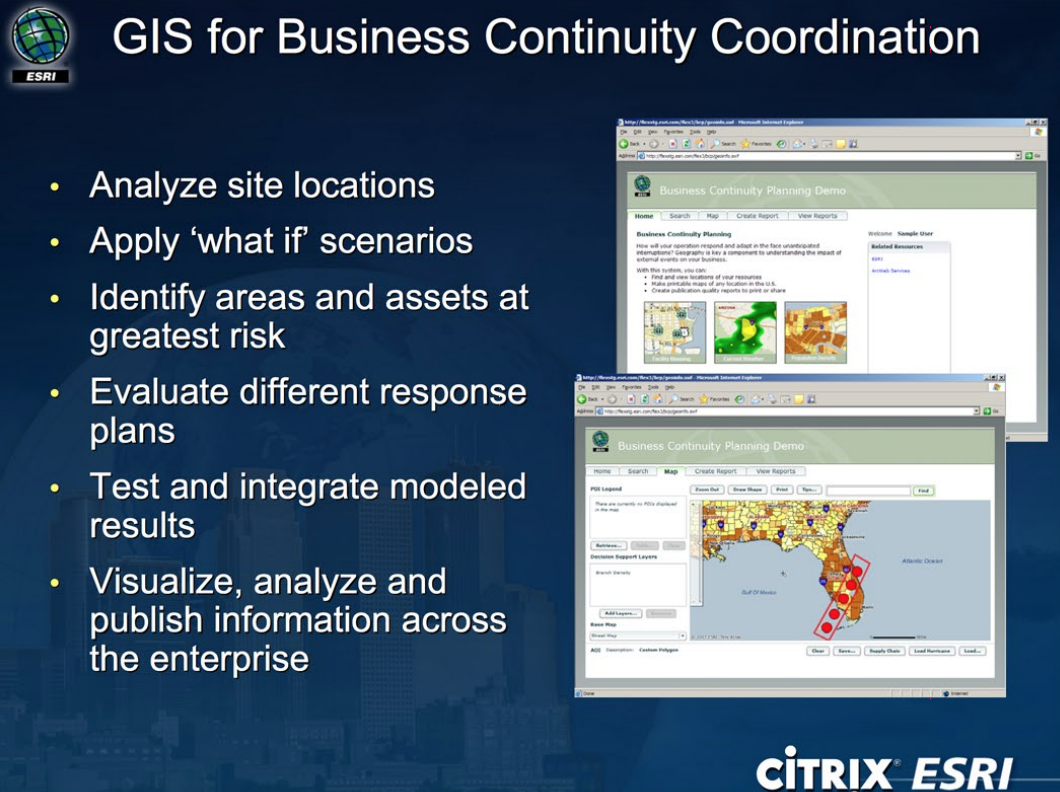

Aside from these theoretical accounts, one can see the scenario planning worldview in the actual self-accountings of logistical actors. For example, an advertisement for Sungard Availability Services, a company that specializes in business continuity and the recovery of data following a disaster, shows how thoroughly the scenario planning sense of the world has penetrated certain business fields: “Make the Everyday Happen in an Environment that is Anything But Normal,” the advertisement reads [Figure 3]. The everyday and the normal—the predictable, the statistically likely—is here presented as not given, as something that needs to be artificially instated through the help of a corporation trained to combat disruptions. The implication of this ad is that, contrary to the regularized world of actuarial science, turbulence and lack of continuity are now the standard states. Additionally, at the purely graphic level, scenario planning’s diagrams of splitting futures (see Pierre Wack’s continually multiplying arrow diagram for Shell Oil for a particularly illustrative example [Figure 4]) find their way into the business continuity’s representational language, which is replete with paths dividing in separate directions [Figure 5].

![]() Fig. 4

Fig. 4

![]() Fig. 5

Fig. 5

It is important here to state that the logistical enterprise, and business continuity companies in particular, do not just share the scenario planning mindset— many of the agencies that specialize in business continuity explicitly use scenario planning methods to speculate on and preemptively manage future disasters. FEMA’s Emergency Planning Exercises page,which is oriented towards helping the private sector “identify innovative, atypical solutions to an unprecedented catastrophic event,” tellingly does not offer a set of protocols or a table of probability statistics but [26] instead puts forward a series of disaster scenarios for corporations to play through. These disaster training regimens—which cover everything from a chemical accident to a cyber attack—take the form of elaborate fictions, complete with fake news broadcasts [Figure 6] and scripts [Figure 7]. Rather than manage future risks through insurance, these videos manage future uncertainties through the creation of realistic fictions. One manages uncertainty by turning it into actuality—only by granting the uncertain a reality is one able to produce a response.

![]() Fig. 6

Fig. 6

![]() Fig. 7

Fig. 7

However, as FEMA’s multiple disaster scenarios shows, not one future reality is conjured, but many. It is here, in the need to account for multiple potential futures, that the spatial implications of a scenario planning logic come into play. Not only are these various scenarios key elements of citing a business [Figure 8], but more importantly, the fact that all potential futures are in play means that no site, ultimately, is to be considered beyond the pale of potential catastrophe. Every business, in the eyes of the scenario-inflected continuity industry, requires not just one space but an auxiliary space to mitigate against future disruptions. And so, you get entire companies that are dedicated to providing these auxiliary, only-when-needed space. Of course, since they too are prone to the uncertain future, these extra spaces need to be distributed across the globe so as to avoid a potential catastrophe [Figure 9]. Oftentimes these extra office spaces are otherwise used as co-working spaces, showing that in a world of uncertain futures, space becomes flexible.

![]() Fig. 8

Fig. 8

![]() Fig. 9

Fig. 9

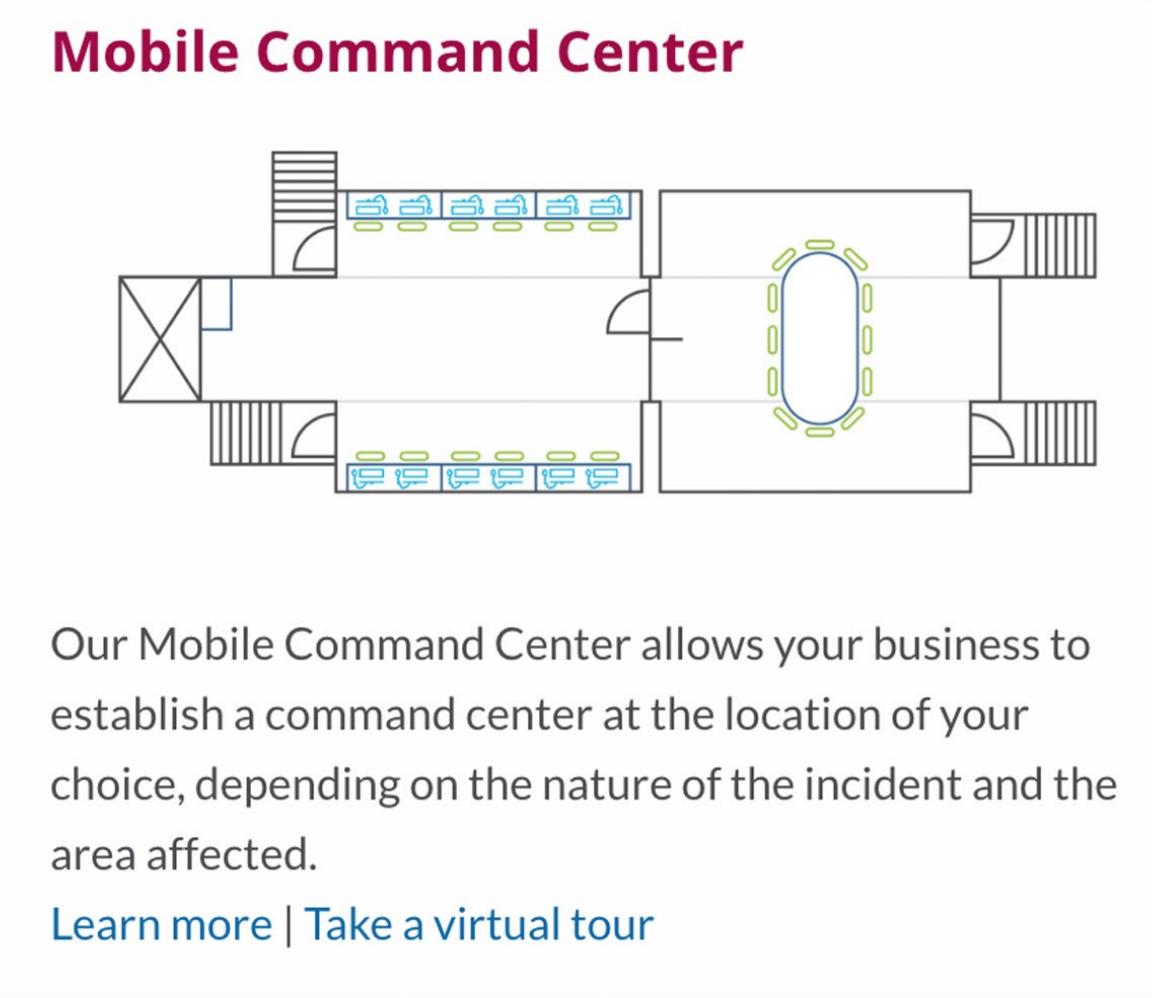

Sometimes aggressively so: the continuity services company Rentsys not only provides permanent office space, they also provide mobile recovery office spaces [Figure 10]. Such a situation could not be more different from an insurantial order. Where space was once permanently sited and permanently calculable it is now conditioned by uncertainty and always on the move.

![]() Fig. 10

Fig. 10

I was studying these tables. Take a look at them. Here’s suicide by race, by color, by occupation, by sex, by locality, be seasons of the year, by time of day when committed. Here’s suicide by method of accomplishment. Here’s method of accomplishment subdivided by poisons, by firearms, by drowning, by leaps … [Here] are leaps subdivided by leaps from high places, under wheels of moving trains, under wheels of trucks, under the feet of horses, from steamboats. But there’s not one case here out of all these millions of cases of a leap from the rear of a moving train. That’s just one way they don’t do it.[1]

His speech, breathless and list-like, rhetorically performs a comprehensibility. One is given the sense that his actuarial tables are potentially all-encompassing—with more and more “here’s’ ” Keyes could effectively elaborate the sum total of suicide possibilities. Significantly, this list of statistically allowable categories is granted enormous predictive powers: that which is “not classifiable” according to the probabilistic logics of actuarial science, Keyes implies, is effectively “an ontological impossibility.” If some future circumstance cannot be inferred from the probabilities [2] suggested by the data available in the present, it may as well not exist.

Years later, at the height of Cold War hysteria, Herman Kahn of the RAND Corporation was putting forward the opposite worldview: that which is statistically unfathomable (in this historical circumstance, Nuclear War or another atomic disaster), he argued, is precisely what one cannot disregard. The probabilistic logics that dominated future-forecasting in days past, Kahn contended, were unsuitable for dealing with unprecedented events about which there is a “paucity of actual examples.” In this situation of uncertainty, Kahn proposed a new method of [3] speculation which he called “scenario planning.” Defined as an “attempt to describe in more or less detail some hypothetical sequence of events” scenarios take the form of [4] imagined narratives that “dramatize and illustrate” the “larger range of possibilities that must be considered in the analysis of the future,” thereby ensuring that the futurist “deal[s] with details and dynamics that he might easily avoid treating if he restricted himself to abstract considerations.” Thus, here the abstractions of statistics [5] are viewed with suspicion and the unpredictable is not written off as an “ontological impossibility,” but is instead granted an ontological reality; that is, through a speculative narrative the unknowable is made to seem real.

This method of giving narrative life to alternative futures far outlived its Cold War origins. In 1961 Kahn left RAND to form the Hudson Institute, his own think tank/consultancy where, amongst other futurological activities, he created the “Corporate Environment Study,” a seminar designed to teach “the secrets of scenario” planning to corporate planners across the globe. His most notable pupil was Pierre [6] Wack, a planner at Shell Oil who would go on to use and adapt Kahn’s scenario methods to analyze the possible changes in the supply and demand of oil. Wack outlined a number of potential scenarios including a “crisis scenario,” in which he imagined Middle Eastern countries limiting oil production for political reasons. This scenario, which bore great resemblance to the OPEC crisis of 1973, helped Shell Oil to weather that embargo with comparatively little losses, a success story that served as an advertisement for the values of the scenario planing to corporations everywhere.[7] Scenario planning, along with business continuity planning and other practices oriented towards managing more micro-level uncertainties, are now mainstays of management culture.

I am curious about the rise of this second form of future management and what it might say about the contemporary logistics-oriented business world that now employs it. Might the turn to a future-strategy as speculative and pluralizing as [8] scenario planning reveal something about the logistical mindset? I hope to show that some of the conceptual ideas underlying Kahn’s embrace of scenario planning— specifically, a chaos-theory inflected view (which I will explain explain below) that sees the components of the physical world as so interrelated that even minor actions produce major effects—have an elective affinity with some of the realities of the contemporary supply chain, that is, a system in which each part is intricately dependent upon the other. Additionally, I will argue that scenario planning’s strategy for dealing with the uncertainties that result from an overly complex world—the creation of multiple possible futures—bears great similarity to the endless disaster recovery and business continuity plans that are required for the functioning of the logistical operation. Finally, through an analysis of some actors in the Business Continuity Industry I will attempt to show that the spatial logics of accounting for a variety of potential disasters are very different from the spatial logics of an insurantial system, which deals less with risk-mitigation and more with the financial spreading of risks whose likelihoods it knows well in advance. Risk mitigation produces distributed sites with no center, or, at the very least, auxiliary sites for each major operation. But, before undertaking an analysis of Scenario Planning and its relationship to logistics, it will be necessary to examine in greater detail the insurantial and probabilistic logics against which Scenario Planning defines itself.

The philosopher of science Ian Hacking dates the rise of probability to the midnineteenth century, a time that produced an “avalanche of printed numbers.” Hacking [9] attributes this increase in numerical data principally to the new Industrial era. The rise of numerical records, he writes, is “embedded in the grander topics of the Industrial Revolution. The acquisition of numbers by the populace, and the professional lust for precision in measurement, were driven by familiar themes of manufacture, mining, trade, … railways.” From this industrial data emerged a new worldview: in contrast to [10] notions of causality and inexorable human natures, mathematicians discovered, in the 19th century’s vast numbers, the laws of probability and statistics. In so doing, the “idea of human nature was displaced by a model of normal people with laws of dispersion.” [11]

Through these new sciences emerged the enterprise of insurance, and with it, the notion of risk, which Francois Ewald argues “has no precise meaning other than as a category of [insurance] technology.” Ewald describes risk as the statistical likelihood of an event occurring that will have a negative effect on “values or capitals possessed or represented by a collectivity of individuals.” The notion of collectivity here is key: the [12] science of probability only works when one has large enough numbers of people engaged in the same behavior over a long enough period of time—this way, one has enough data from which to draw statistical inferences. Risk, in fact, only becomes calculable “when it is spread over a population. The work of the insurer is, precisely to constitute that population by selecting and dividing risks. Insurance can only cover groups; it works by socializing risks. It makes each person a part of the whole.” There [13] is no possible way to determine the likelihood of a specific individual enduring an accident. But if that person is considered as part of a community of, say, miners, there are enough statistics on mining accidents over the years to precisely calculate his risk of injury.

Ewald himself points to mining (and industrial workplace accident insurance in mid-nineteenth century in general) as being a prototypical example of a wellfunctioning insurance market. Years upon years of repeating the same activity in countless similar mine sites produces a highly robust set of statistics from which can be extracted accurate probabilities of an accident occurring. Moreover, any disasters that occurred at a mine would be limited to that site—only the miners would be affected by a cave-in—so it is very easy to to determine who is bearing the risk. Indeed, Ewald sees this industrial-era insurance as so well-functioning that he posits it as central to the world order of the time:

The technology of risk, in its different epistemological, economic, moral, juridical and political dimensions becomes the principle of a new political and social economy … Insurance at the end of the nineteenth century signifies at once an ensemble of institutions and the diagram which which industrial societies conceive their principle of organization, functioning and regulation. Societies envisage themselves as a vast system of insurance.[14]

How then did we pass from such a situation—in which probabilistic thought was arguably a central pillar of social cohesion—to a world highly influenced by scenario planning, a field that “reject[s] claims about a turbulent future in probability terms” as “irrelevant” and “meaningless”? One hypothesis for our shift into [15] alternative means of monitoring the future is offered by Ulrich Beck and his theory of the “risk society.” In our era of advanced, techno-scientific industry (Beck’s Risk Society was released in 1986, coincident with the Chernobyl disaster, the exact kind of situation that one of Kahn’s apocalyptic scenario-planning mind would have salivated over), Beck argues, we face potential catastrophes of a “different quality” than the previous industrial era. Beck has in mind here vast environmental degradation, radioactive decay, nuclear disasters, and the presence of toil chemicals in our air and foodstuffs. These potential disasters are of a size, timeframe and irregularity that is unprecedented. Whereas the effects of previous accidents rarely extended beyond their immediate site—say, the industrial mine—chemical or nuclear accidents potentially affect the entire globe. These effects are likewise extended in time, oftentimes “outlast[ing] generations.” These factors, Beck argues, have resulted in a world [16] system that is “beyond the insurance limit.” That is, because these disasters are [17] exceptional, there is not enough data to determine their probability, and because these potential catastrophes are so extensive, we are no longer able to effectively separate people into the populations that allow us to determine risk. Statistics and probability no longer hold.

When a potential event passes beyond the threshold of these calculative logics, it ceases, definitionally, to be a risk. Instead, Ewald argues, it becomes an “uncertainty,” which he defines as something that one can “apprehend” (one knows, for example, that a nuclear disaster is possible) “without being able to assess” (there is no way to calculate the statistical likelihood of nuclear attack occurring). This eclipse [18] of insurantial reason via the dangers of advanced industry sets the stage for Kahn’s scenario planning methods. Without statistics, there is “a sort of hiatus and time-shift between the requirements of action and the certainty of knowledge.” In such a situation, Ewald argues, it “will be necessary to take into account what one can only imagine, suspect, presume, or fear.” Hence Kahn’s narrative speculations.

This awareness of the geographically extensive and unknowable dangers posed by technoscientifically advanced industries—of which nuclear war is the ultimate representation—however, was not the only force contributing to the rise of scenario planning. There were, in the 1960s, developments in mathematics that called into [20] question the notion that calculative logics are able to predict the future with any certainty at all. In 1961, MIT meteorology professor Edward Lorenz was running highly advanced (for the time) weather simulations, when he left his office to get a cup of coffee. Prior to running his simulations he’d rounded down a data entry three decimal points (from .506127 to .506). Lorenz returned from his break to find that the minor alteration had “drastically transformed” the entire pattern of the results of his weather model, showing that “small changes can have large consequence” and that, therefore, “forecasting the future can be nearly impossible.” R. John Williams, in his account of [21] these events, argues that this discovery (which formed the backbone of chaos theory and has since become know colloquially as the “butterfly effect”) showed that “the increasingly dazzling powers of mechanized computation, rather than fulfilling the Laplacian promise of total prediction and futurological singularity, led instead to a radically proliferating system of bifurcations and chaotic plurality.” It is with this [22] radical discovery as a backdrop, Williams argues, that we can make sense of Herman Kahn’s embrace of scenario planning over more statistically-inclined studies that use “high-speed computer[s]” in an “attempt to “find the ‘optimum’ system, given some reasonably definite set of circumstances, objectives, and criteria.”[23]

Thus we see that scenario planning represents a massive shift in terms of how knowledge about the future and potential threats is conceived—and really, it constitutes a major shift in the conceptualization of the interrelation of society’s members. If insurantial logic is predicated upon the carving up of the social body into clearly demarcated groups of populations, each with its own independent risk profile that is not affected by the risks of other segments of the population, the logics undergirding scenario planning could not be more different: here potential negative effects are completely extensive; through the influence of chaos theory, all parts of the social whole are seen to be intricately related, such that a small change in one area can have affects throughout the entire system. It is here, in its conception of the complete inter-connectivity of all parts of the social world, that I believe scenario planning most dovetails with the logics of logistics.

Fig. 1

Fig. 1 Fig. 2

Fig. 2For the science of logistics is likewise predicated upon the notion that all parts of an operation must be seen in relation to one another. In his essay “The Logistics Revolution and Transportation” W. Bruce Allen describes logistics as exactly such an inter-connected system. Allen contrasts the frame of mind of a “typical” corporate actor with that of a logistician. The traditionalist, he writes, takes as a given that “x tons of widgets must be shipped from A to B” and then asks herself “what is the cheapest fulldistribution cost mode to ship by?” The logistically-oriented, in contrast, “ask[s] questions of whether x was the best amount to ship and whether to ship from point A to point B was the proper origin-destination pair.” In logistics, then, no variables are pre-determined, and, in a true Lorenzian manner, no variable can be written off as insignificant; any alteration could affect the functioning of the logistical operation and so should be considered in the final layout of affairs. Furthermore, just as the highcomputational powers of Lorenz’s modeling system revealed greater chaos and plurality, so too does the logistical operation begin to look more and more everchanging and unpredictable as it expands its processing power. And so we see, in Peter Klaus and Stefanie Müller’s survey of logistical thought, that as logistics adds to its equation not just “traditional intra-organizational and cross-organizational supply chain” issues but also factors at the scale of “national and international cooperation” the result is not a increasingly optimal and precise operation. Instead, as logistics is able to cogitate more and more variables—from “macro-flows of goods, money, and people” to soon-to-be-scare resources such as “crude oil and water” to the shifting “comparative advantages between nations”—it has to imagine a new “type of network structure” that is able to take into account “conditions of ever more turbulent, volatile natural, economic, and political environments.” The future looks more uncertain, and [25] logistics must become, by consequence, preemptive and reactive.

Fig. 3

Fig. 3

Aside from these theoretical accounts, one can see the scenario planning worldview in the actual self-accountings of logistical actors. For example, an advertisement for Sungard Availability Services, a company that specializes in business continuity and the recovery of data following a disaster, shows how thoroughly the scenario planning sense of the world has penetrated certain business fields: “Make the Everyday Happen in an Environment that is Anything But Normal,” the advertisement reads [Figure 3]. The everyday and the normal—the predictable, the statistically likely—is here presented as not given, as something that needs to be artificially instated through the help of a corporation trained to combat disruptions. The implication of this ad is that, contrary to the regularized world of actuarial science, turbulence and lack of continuity are now the standard states. Additionally, at the purely graphic level, scenario planning’s diagrams of splitting futures (see Pierre Wack’s continually multiplying arrow diagram for Shell Oil for a particularly illustrative example [Figure 4]) find their way into the business continuity’s representational language, which is replete with paths dividing in separate directions [Figure 5].

Fig. 4

Fig. 4 Fig. 5

Fig. 5It is important here to state that the logistical enterprise, and business continuity companies in particular, do not just share the scenario planning mindset— many of the agencies that specialize in business continuity explicitly use scenario planning methods to speculate on and preemptively manage future disasters. FEMA’s Emergency Planning Exercises page,which is oriented towards helping the private sector “identify innovative, atypical solutions to an unprecedented catastrophic event,” tellingly does not offer a set of protocols or a table of probability statistics but [26] instead puts forward a series of disaster scenarios for corporations to play through. These disaster training regimens—which cover everything from a chemical accident to a cyber attack—take the form of elaborate fictions, complete with fake news broadcasts [Figure 6] and scripts [Figure 7]. Rather than manage future risks through insurance, these videos manage future uncertainties through the creation of realistic fictions. One manages uncertainty by turning it into actuality—only by granting the uncertain a reality is one able to produce a response.

Fig. 6

Fig. 6 Fig. 7

Fig. 7However, as FEMA’s multiple disaster scenarios shows, not one future reality is conjured, but many. It is here, in the need to account for multiple potential futures, that the spatial implications of a scenario planning logic come into play. Not only are these various scenarios key elements of citing a business [Figure 8], but more importantly, the fact that all potential futures are in play means that no site, ultimately, is to be considered beyond the pale of potential catastrophe. Every business, in the eyes of the scenario-inflected continuity industry, requires not just one space but an auxiliary space to mitigate against future disruptions. And so, you get entire companies that are dedicated to providing these auxiliary, only-when-needed space. Of course, since they too are prone to the uncertain future, these extra spaces need to be distributed across the globe so as to avoid a potential catastrophe [Figure 9]. Oftentimes these extra office spaces are otherwise used as co-working spaces, showing that in a world of uncertain futures, space becomes flexible.

Fig. 8

Fig. 8 Fig. 9

Fig. 9Sometimes aggressively so: the continuity services company Rentsys not only provides permanent office space, they also provide mobile recovery office spaces [Figure 10]. Such a situation could not be more different from an insurantial order. Where space was once permanently sited and permanently calculable it is now conditioned by uncertainty and always on the move.

Fig. 10

Fig. 101. James M. Cain, Double Indemnity (New York: Vintage Books, 1992), 59-60. The novel was published in 1943, though serially syndicated years earlier in 1936.

2. Frederick Whiting, “Playing Against Type: Statistical Personhood, Depth Narrative, and the Business of Genre in James M. Cain’s ‘Double Indemnity,’” Journal of Narrative Theory 36, no. 2 (Summer 2006): 201.

3. Herman Kahn and Anthony J. Weiner, The Year 2000: A Framework for Speculation on the Next Thirty-Three Years (New York: Macmillan, 1967), 263.

4. Herman Kahn, Thinking about the Unthinkable (New York: Avon, 1962), 150.

5. Kahn, The Year 2000, 263, as quoted in R. John Williams, “World Futures,” Critical Inquiry 42 (Spring 2016): 522.

6. Williams, “World Futures,” 524.

7. Kees van der Heijden, Scenarios: The Art of Strategic Conversation (New York: John Wiley & Sons, Inc., 1996), 17-19.

8. It is important here to point out that although scenario planning presents a new method of addressing the future, it did not in any way wholly supplant probabilistic means. Traditional insurantial logics continue to hold in many areas, and, as Richard V. Ericson, Aaron Doyle and Dean Barry have argued, even situations that “defy insurance logic because they are surrounded by uncertainty” such as “natural disasters and technological catastrophes” continue to be covered by the industry. “The [insurance industry],” they write, “… will insure just about anything. Insurers gamble, trying to manage any fallout through a variety of pricing, claims control, financial risk redistribution, and investment strategies” Richard V. Ericson, Aaron Doyle and Dean Barry, Insurance as Governance (Toronto: University of Toronto Press, 2003), 9.

9. Ian Hacking, The Taming of Chance (Cambridge: University of Cambridge Press, 1990), xiii.

10. Ibid., 5.

11. Ibid., xiii.

12. Francois Ewald, “Insurance and Risk,” in The Foucault Effect: Studies in Governmentality, ed. Graham Burchell, Colin Gordon and Peter Miller (Chicago, IL: University of Chicago Press, 1911), 198-199.

13. Ibid., 203.

14. Ibid., 210.

15. Kees van der Heijden et al., “Turbulence, Business Planning and the Unfolding Financial Crisis,” in Business Planning for Turbulent Times: New Methods for Applying Scenarios, ed. Rafael Ramirez et al. (London: Earthscan Ltd, 2010), 270.

16. Ulrich Beck, Risk Society: Towards a New Modernity (London, UK: Sage Publications, 1992), 16 22.

17. Ulrich Beck, “Risk Society and the Provident State,” in Risk, Environment and Modernity: Towards a New Ecology, ed. Scott Lash, Bronislaw Szeszynski and Brian Wynne (London, UK: Sage Publications, 1996), 31.

18. Francois Ewald, “The Return of Descartes’s Malicious Demon: An Outline of a Philosophy of Precaution,” in Embracing Risk: The Changing Culture of Insurance and Responsibility, ed. Tom Baker and Jonathan Simon (Chicago, IL: University of Chicago Press, 2002), 286.

19. Ibid., 294.

20. Since I am arguing that the rise of Beck’s “risk society” contributed to Kahn’s scenario planning worldview it is important to note that although Risk Society was not published until 1986, Beck sees “risk society” as beginning much earlier. In fact, he dates the “discovery of the incalculability of risk” all the way back to a publication by Keynes on “uncertain knowledge” in 1937, even before Kahn’s time. Ulrich Beck, “Living in the world risk society,” Economy and Society vol. 35 no. 3 (August 2006): 334.

21. Peter Dizikes, “When the Butterfly Effect Took Flight,” MIT Technology Review, February 22, 2011, https://www.technologyreview.com/s/422809/when-the-butterfly-effect-took-flight/.

22. Williams, “World Futures,” 482.

23. These descriptions of the optimizing logics of “high-speed computers” come from Herman Kahn’s On Thermonuclear War, wherein he first outlined his scenario planning method. In that text, Kahn rhetorically asks himself, “‘Do you want to argue with an electronic machine backed up by all the resources of modern science?’” The “only possible answer to that question,” he replies, “is ‘Yes.’” Herman Kahn, On Thermonuclear War (Princeton: Princeton University Press, 1960), 119. As quoted in Williams, “World Futures,” 482.

24 W. Bruce Allen, “The Logistics Revolution and Transportation,” Annals of the American Academy of Political and Social Science, vol. 554 (September 1997): 114.

25 Peter Klaus and Stefanie Müller, “Towards a Science of Logistics: Milestones along Converging Paths,” in The Roots of Logistics: A Reader of Classical Contributions to the History and Conceptual Foundations of the Science of Logistics, ed. Peter Klaus and Stefanie Müller (Heidelberg: Springer, 2012), 20. Given their analysis—where the culmination point of logistics’s expanding purview is the need to design for the inevitable turbulence of our complex world—the similarity between Lorenz’s chaos theory diagrams [Figure 1] and the overlapping lines of shipping routes by which the logistical operation is frequently represented [Figure 2] feels like more than a coincidence.

26. https://www.fema.gov/emergency-planning-exercises

2. Frederick Whiting, “Playing Against Type: Statistical Personhood, Depth Narrative, and the Business of Genre in James M. Cain’s ‘Double Indemnity,’” Journal of Narrative Theory 36, no. 2 (Summer 2006): 201.

3. Herman Kahn and Anthony J. Weiner, The Year 2000: A Framework for Speculation on the Next Thirty-Three Years (New York: Macmillan, 1967), 263.

4. Herman Kahn, Thinking about the Unthinkable (New York: Avon, 1962), 150.

5. Kahn, The Year 2000, 263, as quoted in R. John Williams, “World Futures,” Critical Inquiry 42 (Spring 2016): 522.

6. Williams, “World Futures,” 524.

7. Kees van der Heijden, Scenarios: The Art of Strategic Conversation (New York: John Wiley & Sons, Inc., 1996), 17-19.

8. It is important here to point out that although scenario planning presents a new method of addressing the future, it did not in any way wholly supplant probabilistic means. Traditional insurantial logics continue to hold in many areas, and, as Richard V. Ericson, Aaron Doyle and Dean Barry have argued, even situations that “defy insurance logic because they are surrounded by uncertainty” such as “natural disasters and technological catastrophes” continue to be covered by the industry. “The [insurance industry],” they write, “… will insure just about anything. Insurers gamble, trying to manage any fallout through a variety of pricing, claims control, financial risk redistribution, and investment strategies” Richard V. Ericson, Aaron Doyle and Dean Barry, Insurance as Governance (Toronto: University of Toronto Press, 2003), 9.

9. Ian Hacking, The Taming of Chance (Cambridge: University of Cambridge Press, 1990), xiii.

10. Ibid., 5.

11. Ibid., xiii.

12. Francois Ewald, “Insurance and Risk,” in The Foucault Effect: Studies in Governmentality, ed. Graham Burchell, Colin Gordon and Peter Miller (Chicago, IL: University of Chicago Press, 1911), 198-199.

13. Ibid., 203.

14. Ibid., 210.

15. Kees van der Heijden et al., “Turbulence, Business Planning and the Unfolding Financial Crisis,” in Business Planning for Turbulent Times: New Methods for Applying Scenarios, ed. Rafael Ramirez et al. (London: Earthscan Ltd, 2010), 270.

16. Ulrich Beck, Risk Society: Towards a New Modernity (London, UK: Sage Publications, 1992), 16 22.

17. Ulrich Beck, “Risk Society and the Provident State,” in Risk, Environment and Modernity: Towards a New Ecology, ed. Scott Lash, Bronislaw Szeszynski and Brian Wynne (London, UK: Sage Publications, 1996), 31.

18. Francois Ewald, “The Return of Descartes’s Malicious Demon: An Outline of a Philosophy of Precaution,” in Embracing Risk: The Changing Culture of Insurance and Responsibility, ed. Tom Baker and Jonathan Simon (Chicago, IL: University of Chicago Press, 2002), 286.

19. Ibid., 294.

20. Since I am arguing that the rise of Beck’s “risk society” contributed to Kahn’s scenario planning worldview it is important to note that although Risk Society was not published until 1986, Beck sees “risk society” as beginning much earlier. In fact, he dates the “discovery of the incalculability of risk” all the way back to a publication by Keynes on “uncertain knowledge” in 1937, even before Kahn’s time. Ulrich Beck, “Living in the world risk society,” Economy and Society vol. 35 no. 3 (August 2006): 334.

21. Peter Dizikes, “When the Butterfly Effect Took Flight,” MIT Technology Review, February 22, 2011, https://www.technologyreview.com/s/422809/when-the-butterfly-effect-took-flight/.

22. Williams, “World Futures,” 482.

23. These descriptions of the optimizing logics of “high-speed computers” come from Herman Kahn’s On Thermonuclear War, wherein he first outlined his scenario planning method. In that text, Kahn rhetorically asks himself, “‘Do you want to argue with an electronic machine backed up by all the resources of modern science?’” The “only possible answer to that question,” he replies, “is ‘Yes.’” Herman Kahn, On Thermonuclear War (Princeton: Princeton University Press, 1960), 119. As quoted in Williams, “World Futures,” 482.

24 W. Bruce Allen, “The Logistics Revolution and Transportation,” Annals of the American Academy of Political and Social Science, vol. 554 (September 1997): 114.

25 Peter Klaus and Stefanie Müller, “Towards a Science of Logistics: Milestones along Converging Paths,” in The Roots of Logistics: A Reader of Classical Contributions to the History and Conceptual Foundations of the Science of Logistics, ed. Peter Klaus and Stefanie Müller (Heidelberg: Springer, 2012), 20. Given their analysis—where the culmination point of logistics’s expanding purview is the need to design for the inevitable turbulence of our complex world—the similarity between Lorenz’s chaos theory diagrams [Figure 1] and the overlapping lines of shipping routes by which the logistical operation is frequently represented [Figure 2] feels like more than a coincidence.

26. https://www.fema.gov/emergency-planning-exercises